Bread Financial App

Anchoring a Direct-to-consumer strategy

the opportunity

Part of the rebrand to Bread Financial was a pivot from a strict B2B2C acquisition model to one that created a more direct relationship with our customers. The issue we faced with the existing model was how do we retain consumers when a merchant decides to end their relationship with Bread Financial. The vast majority of our customer acquisition was through merchant relationships. In addition we wanted to address these secondary objectives as well:

How do we incorporate Bread Payment’s product suite from an acquisition and servicing model

How do we target an increasing mobile first demographic in the financing space

Long term, how do we create loyalty with our consumers and move beyond a strictly transactional based relationship

my role & the team

My Responsibilities

Design Strategy

Executive Stakeholder Management

Design Leadership

Product Strategy

Product Roadmapping

Ideation

Leadership Team

SVP, Product

Director of Product, Card Services

VP of Product, New Business Enablement

CTO

Director of Engineering, Card Services

VP, Strategic Initiatives

Senior Director of Product Design (me)

Project Team

Lead UX Researcher

UX Content Writer

3 Product Designers

2 Product Managers

Data Analyst

8 Engineers

1 Project Manager

Vision

Building loyalty with existing and new Bread Financial customers by creating experiences and features that will not just unlock deals and saving but will serve as a companion throughout their financial journey

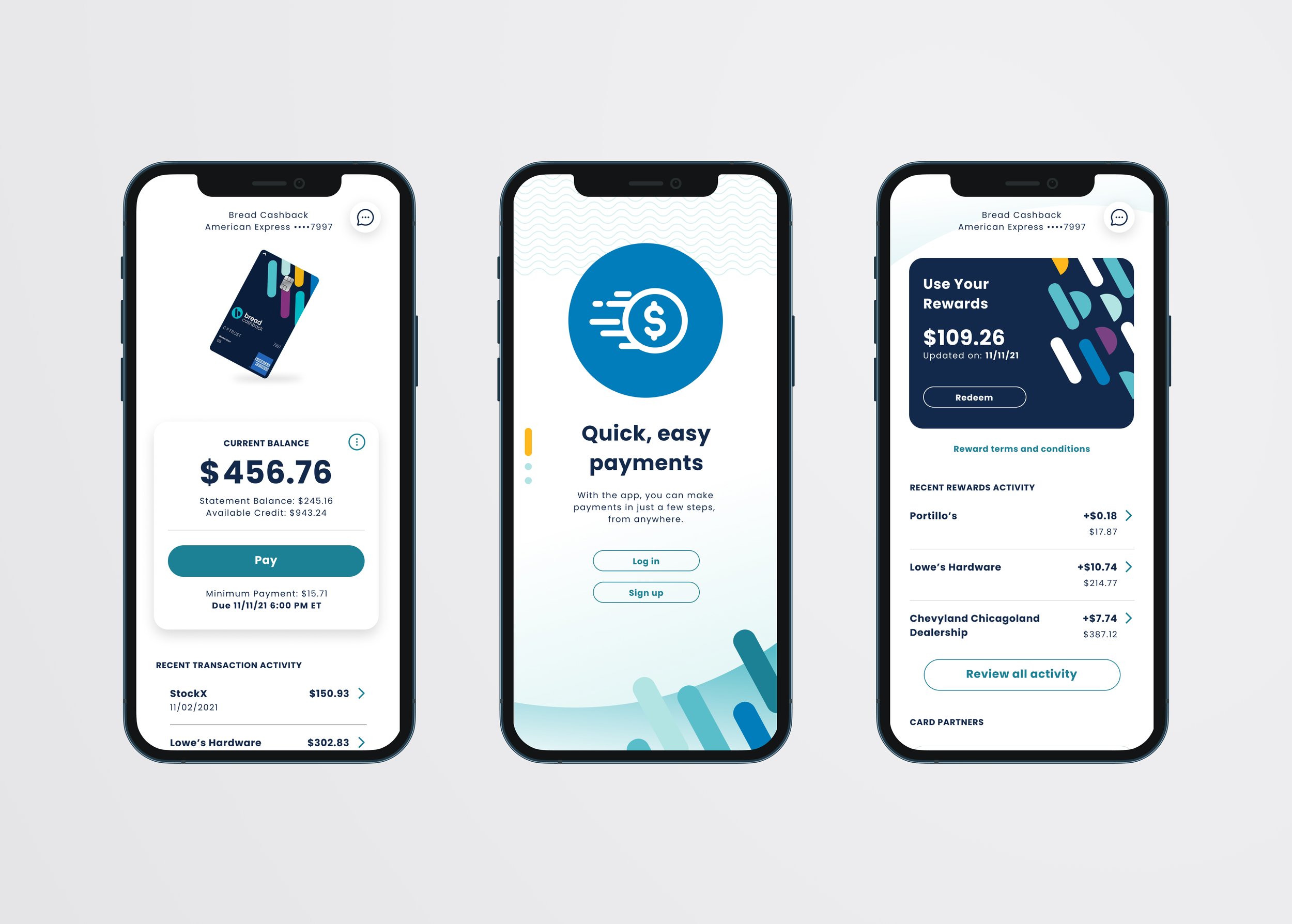

phase 01 experience

We landed on a set list of features to prioritize for our Phase 01 launch, based on table stakes features needed to complete core tasks, competitive analysis, user research, and performative analytics from our website to inform which features garnered the highest customer usage.

Welcome

Entice consumers to register their card and sign in.

Dashboard

Display updated balance and push towards payment.

Account Settings

Give consumers control over app and account preferences.

Bill Pay

Allow for easy payment and account setup.

Rewards

Facilitate a seamless rewards experience and payout.

User testing

We conducted 4 rounds of consumer validation at critical checkpoints through out the design process. Our research focused on six areas of the Phase 01 experience: EULA & Home Page, Dashboard & Navigation, Bill Pay, Adding Payment Source, Registration, and Rewards. Below are some high level insights generated through out the research process.

EULA & Public Home Page:

Most users (3/4) asked whether anyone reads the license agreement.

The term ‘Register’ was straight forward to all users and expected to lead to creating a username and password.

Dashboard & Navigation:

Most users (4/6) found this Card Summary design most helpful.

All users knew where to find Rewards easily.

The vast majority of users found the app navigation intuitive and enjoyed micro-interactions

Payments:

Most users enjoyed the payment slider and enjoyed using it because it gave them the flexibility to pay more

phase 01 designs

Initial results

Phase 01 release of the app was limited to Bread Financial Cash Back Amex cardholders due to backend re-architecture constraints and the initial release was delayed due to migration issues. Once released, we noticed 30.6% of cardholders downloaded the app (103k first time downloads to date), which was better than the forecasted 15-20% we hoped for, and utilize the app for payments and managing cash back rewards. Phase 02 will start to add additional Bread Financial cards and products with the longer term vision of incorporating not just all Bread Financial card products and loans but high yield savings accounts and financial education.