Bread loans

expanding revenue with new products

the OPPORTUNITY

After the acquisition of Bread Payments by Alliance Data, we identified an opportunity to diversify existing business lines and expand revenue by offering a non-point of sale consumer loan product. This would allow us to leverage existing loan servicing systems to target a new and broader audience.

MY ROLE & THE TEAM

My Responsibilities

Design Strategy

Executive Stakeholder Management

Design Leadership

Product Strategy

Product Roadmapping

Ideation

Leadership Team

VP of Product, Bread Payments

Senior Director of Engineering - Checkout

Director of Engineering - Financing

Director of Engineering, Acquisition

Director of Product, New Business Enablement

Senior Director of Product Design (me)

Project Team

2 Product Managers

1 Product Designer

1 UX Researcher

1 UX Content Writer

4 Engineers

1 Quality Assurance Engineer

Scope and strategy

The leadership team decided that in order to reduce scope of Phase 01 and meet our launch timeframe that we would limit the initial scope of the product to the following requirements:

Debt Consolidation Only

Bread’s loan servicing backend had no ACH distribution framework in place, but ADS did have the infrastructure to directly pay off borrow’s credit cards, so as a result, we decided to limit Phase 01 to debt consolidation only.

Gated Experience

We were limiting Phase 01 to 12M existing Bread and ADS customers and wanted to make sure we could control who had access to apply so application was only available to existing customers who would receive the offer email.

Value Propositions

As we looked across the competitive landscape, we landed on three value propositions to help us differentiate between us and some of our competitors:

No hard pull on credit report

Low interest rates

No origination fees

Loan Terms

Amount: $1,500 - $35,000

APR: 5.99% - 19.99%

Terms 36 - 72 months

Concepting

As the team began to craft the wireframes and user flow we decided to leverage our existing Buy Now Pay Later application process since we has already conducted extensive research and A/B testing on the experience, and could reduce engineering time by repurposing the components.

We did how ever need to solve for the loan calculator which we did not have pre-existing designs built or tested. The team identified a few variations on how to solve for this step.

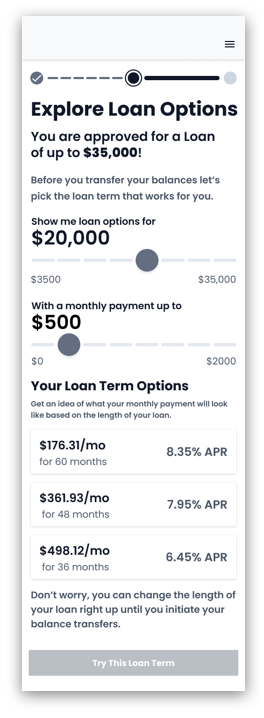

Slider

PROS:

Complete Relative Range Transparency

Low motor load

Low error potential

Highly tactile

Delight factor

CONS:

Take up the most room

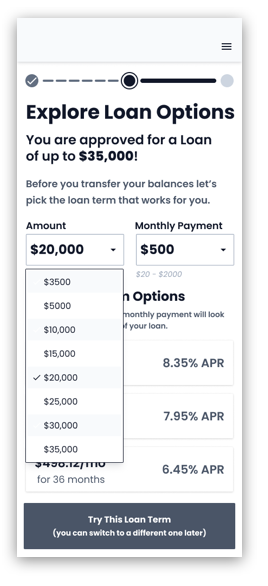

Dropdown

PROS:

Don’t take up much room

Moderate motor load

Full range of options available

CONS:

Relative Range Transparency is not immediately evident

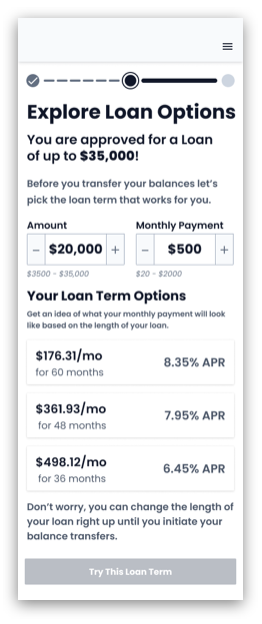

Horizontal Stepper

PROS:

Don’t take up much room

Low error potential

CONS:

Relative Range Transparency is not immediately evident

Higher motor load than other options

Fitts’ Law fail - it could take a long time to get to the number you want

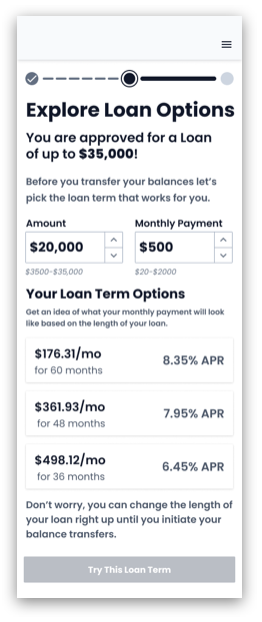

Vertical Stepper

PROS:

Don’t take up much room

Lower motor load than other options

CONS:

Relative Range Transparency is not immediately evident

High potential for error

Concept testing

The team conducted some concept testing to identify the best solution for our Loan Calculator and overwhelmingly the Dropdown performed best in ease of use, accessibility, consumer confidence, and user completion of task.

User Testing

Once we had finalized concept testing of the Loan Calculator, we conducted User Testing with 20 unmoderated participants across both Quantitative (12 participants using score based questions) and Qualitative (8 participants using open ended tasks) methodologies. Our participant panel was all based in the US or Canada, aged 26-62, 7 males, 13 females, and all participants had at least 2 credit cards that carried a balance.

Reactions were largely positive with 100% of participants rating the application and debt consolidation process at being ‘extremely easy to use’ and 95% saying that the overall offering would meet their needs if they were looking for a debt consolidation loan.

There were some snags though as can be expected with a first round of testing.

Marketing Landing Page

Users were enticed by no fees - although several thought that ‘fees’ included interest rates and felt that the information was misleading. Listing “Interest Rates As Low As 5.99%” should fix this problem.

Explore Loan Options

There was some confusion around term length. Several participants didn’t understand why the interest rates were going up - need to make this information more prominent on the cards.

Consolidate Credit Card Debt

Some confusion finding edit and delete icons in the details panel - might move them to be on the right or underneath the account information.

Congratulations Screen

Would like to see more information about what happens next - timeline, when is first payment due.“

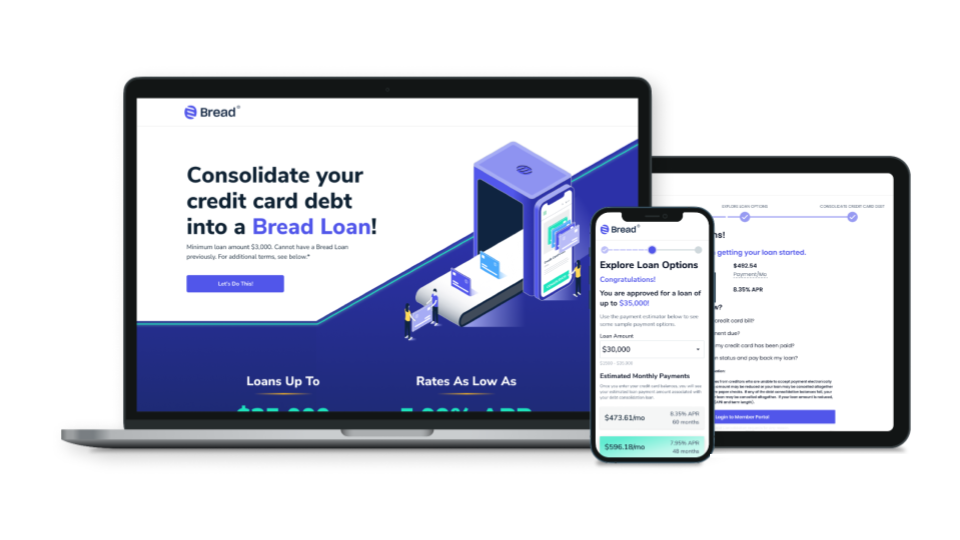

high fidelity designs

After making some adjustments based on our User Testing findings the team landed on this final go-to-market expereince for Phase 01.

how it performed

We launched Phase 01 on November 15, 2021 and implemented a slow role out, 1 million potential customers every few weeks. We established success metrics for the Phase 01 launch an set a goal check in after the first 4 million customers were emailed.

GOALS FOR PHASE 01 - 12MM

Loans: 3,000 (.02%)

Receivables: $15MM ($5k/loan)

Approval Rate: 90%

Take Rate: 15%

PERFORMANCE FOR FIRST 4.5MM

Loans: 1,310 (.03%)

Receivables: $14MM ($11k/loan)

Approval Rate: 53%

Take Rate: 18%

Next Steps

With the initial success of Phase 01 we began planning for Phase 02 and how to expand on the product. Phase 02 would incorporate the following:

Introducing a 24 month term

Adding ACH Personal Loans

Increasing the loan amount cap to $50,000

Lower Credit Score decisioning threshold to help increase approval rate