Bread Merchant Dashboard

redesigning for scalability

the OPPORTUNITY

As part of our enterprise partnership with the Royal Bank of Canada and Fiserv we needed to reimagine our Merchant experience. We traditionally worked with small to medium size merchants with fairly straight forward needs. We onboarded roughly 5-10 merchants per month and the onboarding experience was manual and primarily handled by our Merchant Success team. We now needed to take into consideration a wider range of merchants and their needs, including enterprise tier merchants such as Microsoft, GameStop, Victoria’s Secrets, and Sephora. We also needed to include new product offering such as in-store digital card and how to manage distribution and repayment of Pay Now, Pay Later loans triggered via virtual cards. Lastly, we needed to productize the onboarding experience to handle 100-200x growth in Merchant onboarding. We needed to transform a extremely hands on experience to one that was primarily self-serve for the inbound flow of new merchants via these new partnerships.

My role & the team

My role for this project was collaborating with cross-functional leaders and stakeholders to identify and implement a go-to-market strategy and report progress and strategic design decisions to executive leadership during routine checkins. The key leadership team for this product update included the VP of Product - Bread Payments, Senior Director of Engineering - Merchant, Director of Merchant Success, Director of Implementation, and myself. I also oversaw research and design as well as help inform key design decisions impacting the development of the user experience.

The team I managed for this project consisted of: 1 UX Researcher and 2 Product Designers.

discovery & research

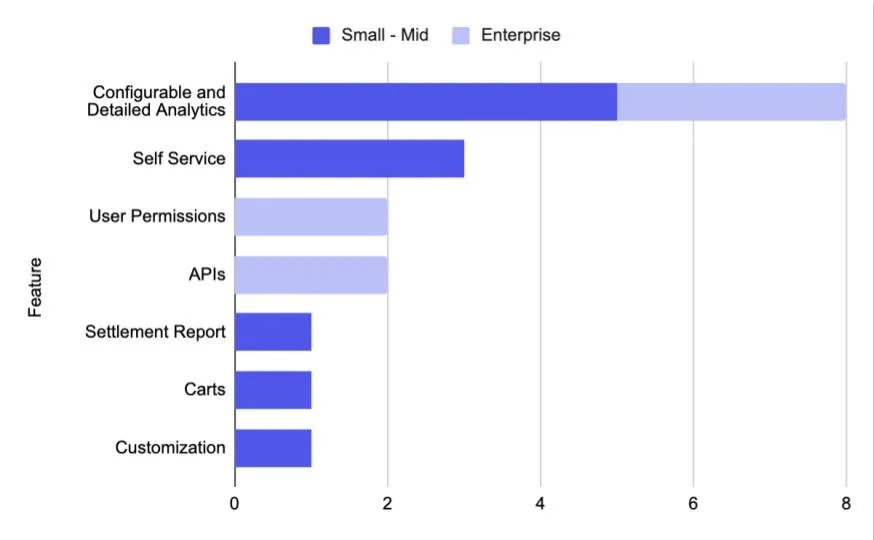

As we looked to understand the diversity between what our varied tier of Merchants’ needs would look like we divided our Discovery research into two phases, External and Internal. We first met with 8 merchants to understand their continued and growing needs with our platform. 5 where small - mid tier merchants who already had an existing relationship with us. 3 where prospective enterprise tier merchants who had volunteered to be part of our Beta group to onboard onto our platform via our relationship with RBC or Fiserv. In our conversations with them we focused on 7 key features that would be the core of our experience.

For the next phase of discovery research we surveyed and spoke with key internal stakeholders and contributors from Merchant Success, Compliance, Marketing, Product, Operations, and Sales about their perception of the value of existing and proposed features for Merchants.

Card sorting exercise

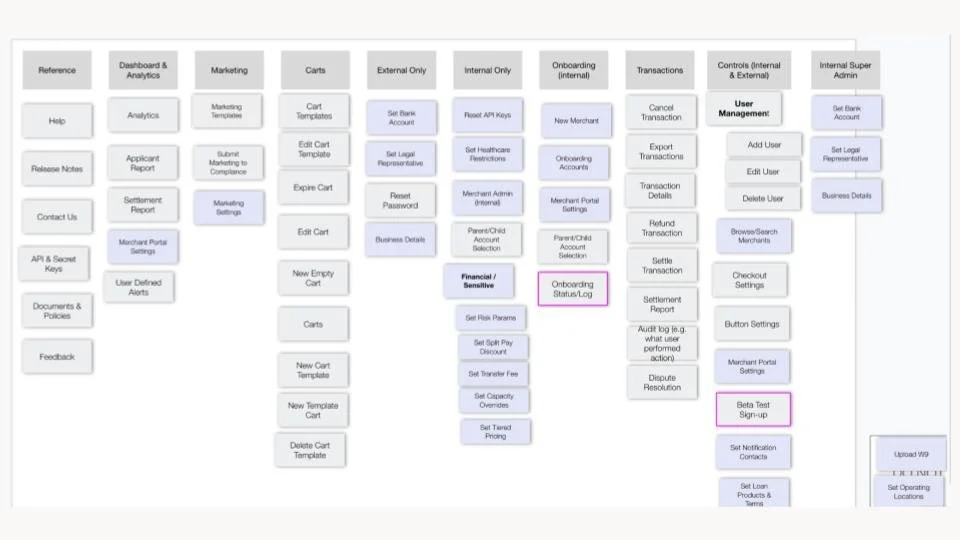

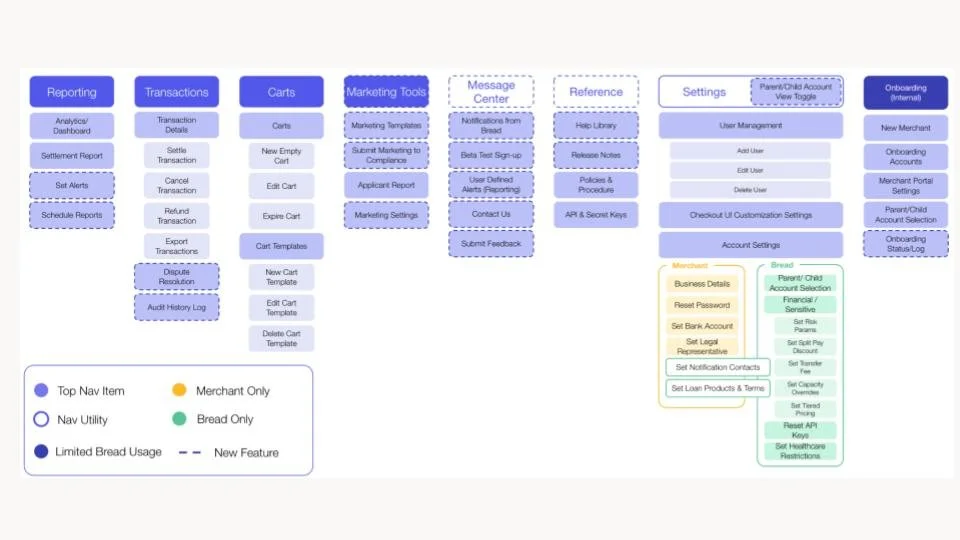

Based on our findings and insights from external & internal discovery, the team decided to conduct two card sorting exercises with Merchants and Internal Stakeholders to prioritize and organize the new and existing features.

roadmap prioritization

Informed by the rounds of Discovery Research and the Card Sorting exercises the team decided on the following release roadmap.

MVP

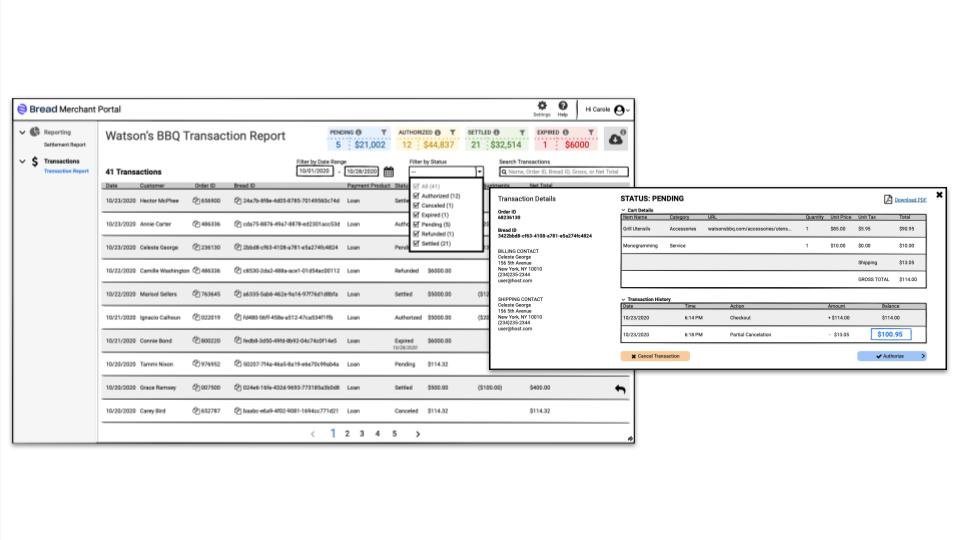

Transaction Report

Settlement Report

User Management

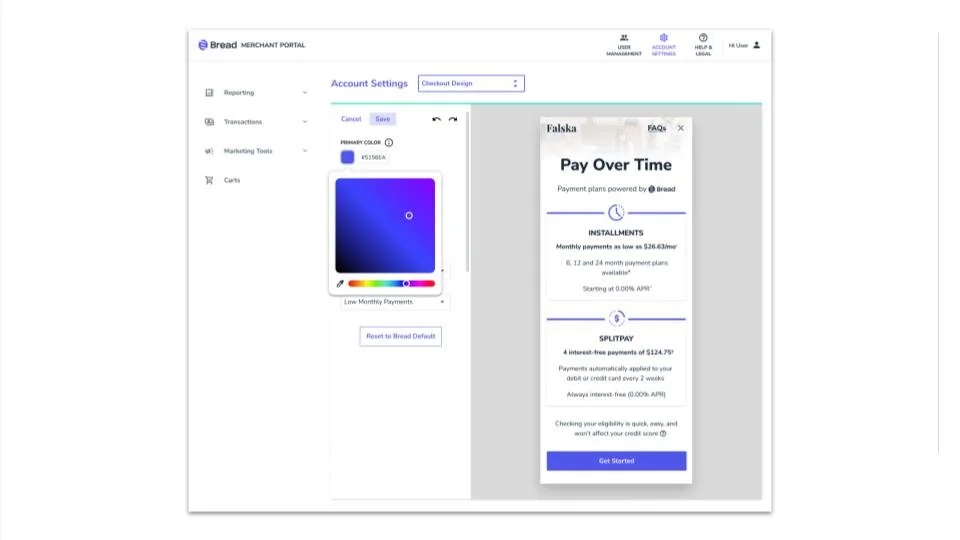

Visual Theming for multi-tenancy

Fast Follows

Basic Account Settings

Applicant Report

Phase 02

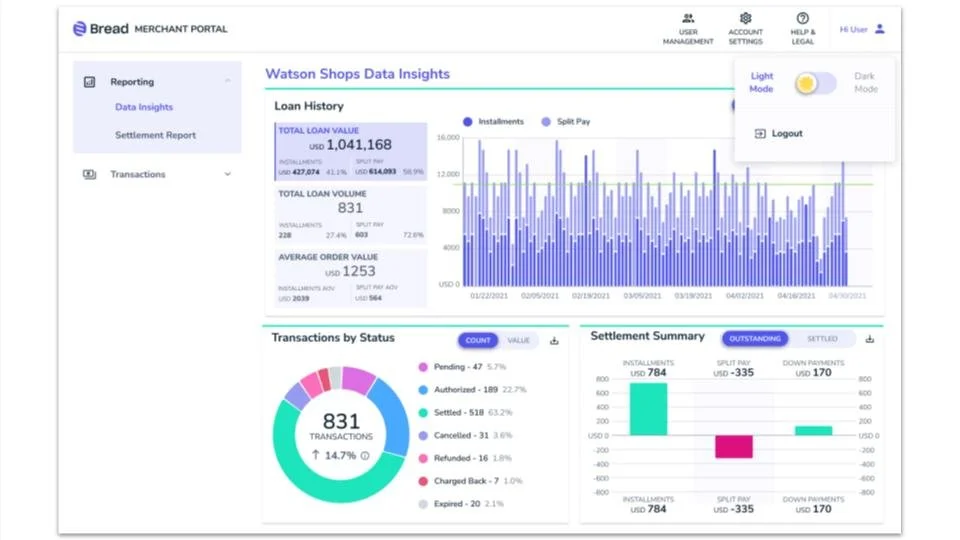

Basic Analytics

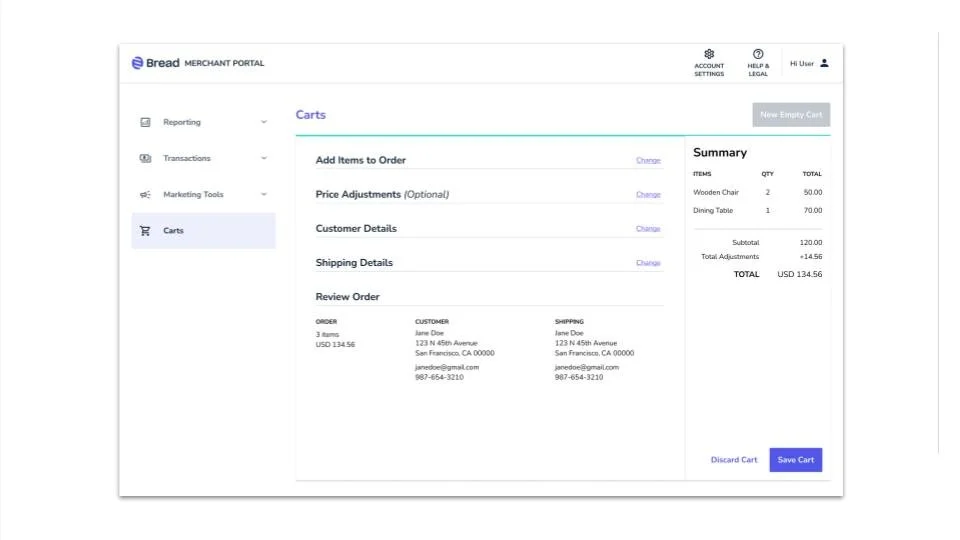

Carts

Advanced Account Settings

Checkout Customization

Phase 03+

Full Parity with Classic Portal

Advanced Analytics

Parent/Child Login

Marketing Tools

Self Service Onboarding

wireframes and final designs

The team conducted two rounds of user testing with 5 existing Merchants to ensure that the new flows and experience was meeting user needs and satisfaction.

impact

With the release of the MVP we tracked several key metrics to measure success:

Implementation Timeframe (time from signed contract to go-live on a Merchant’s website) decreased from an average of 12 days to 7 days.

Merchants were able to access Transaction and Settlement reports daily instead of monthly, which allowed them to adjust poromotion on their sites accordingly.

Due to some automation steps monthly Merchant onboarding increased from 10 per month to 25 per month.

After Fast Follows and Phase 02 we identified an increase in the following metrics:

With Checkout Customization we recorded an average 2.3% increase in checkout conversion across our Merchant base.

We can not directly attribute this to our work, but post launch of the updated experience we recorded an increase in Sales conversion rates.

As well as the increase in sales conversion rate we also recorded an increase in leads conversion rate.

Next Steps

We experienced some issues with the basic level analytics tools we rolled out in Phase 02 we decided to roll that feature back and relaunch in Phase 3. The main focus moving forward is the complete productization of onboarding in order to scale new merchant onboarding from 25 per month to 100+ per month within 3 months.